The 2023-2024 season is presenting a number of uncertainties that will affect sales negatively: high inflation in European countries, high energy prices, and important consequences derived from climate change, which is combining periods of drought and floods.

The concern regarding the availability of irrigation water also cannot be forgotten. A good example is what happened in northern and central Europe, where owing to the cold and to a wet spring, sowing took place later than usual and then the crops were plunged into a long period of drought.

In southern Europe, where the growing area is virtually the same as the previous season’s, the lack of irrigation water meant that the drought months affected all the onion crops.

In spite of the problems and the high prices, in the current season, the demand for onions remains stable. However, there is some uncertainty about the quality, and the losses that could occur in their sorting as most of Europe is recording medium and small calibres. For example, the United Kingdom will have a 11.2% drop; the Netherlands a 5.2% decrease, and there will be -0.2% in Italy.

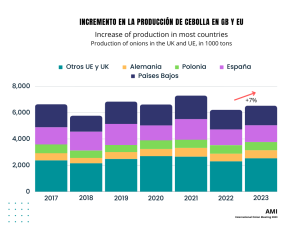

Globally, European production is 7% higher than in the previous campaign, although Spain and the Netherlands, two of the largest producers, are maintaining the same production level.

Here in Spain, the figure will approach 1,270,000 tonnes, and in the latter country, 1,484,000 tonnes, the same figure as the previous year. On the other hand, Germany will rise from 578,000 tonnes to 611,000 tonnes.

The transversal nature of the European harvest, (although this is not the case of the Spanish production, which has a wide variety of sizes), means there is an abundance of 40 to 70 mm calibres.

Germany

Germany has reached a record in its planted surface area. However, the sowing occurred later than usual due to the cold and wet weather conditions. In the first part of the summer, there was a very dry period in which irrigation was completely necessary and, on the other hand, in the second half the rains came and were very beneficial for improving the growth which, in spite of everything, only reached medium calibres.

What is happening in the Netherlands?

The 2022-23 season ended earlier than normal due to the shortage of stored onions.

The 2022-23 season ended earlier than normal due to the shortage of stored onions.

The planted surface area is larger in 2023-24 than in the previous year, but there is a drastic 25% drop in red onions.

As in other countries in northern Europe, sowing took place later than usual due to the cold and wet weather conditions. The first part of the summer was very warm and watering became necessary. On the other hand, in the second part, there was enough rainfall to ensure a suitable growth of the onions.

Prices remain high, particularly because of the shortage in red onions. Exports are sluggish due to the high prices. Some countries that traditionally are mass importers of onions from the Netherlands have changed over to cheaper suppliers and are ordering smaller amounts.

New Zealand is getting ready for exports

The country experienced some difficulties at the beginning of the 2022-23 campaign owing to the bad weather conditions, with serious cyclones and flooding in the fields. El Niño brought heavy rainfall and hail.

In spite of everything, sowing was carried out on time and correctly, with the exception of the region around Pukekohe.

Export conditions have seen an important change due to the increase in costs, but exports to Continental Europe continue to show good results.

This season, the country is increasing its yellow onion crop surface area, although it will have a smaller harvest of red onions.

India, the leader in production

India is the leading onion producer in the world. The crop is divided into two seasons: the first from December to January in the Kharif region, and the second, from April to May, in the Rabi region.

The Rabi season is the most important one and it is also has the highest yields. However, this year the harvest in this region will have quality problems due to the monsoon. Sowing in Kharif also suffered a delay caused by the same winds.

During the last campaign, the government had to intervene to guarantee the supply and only allowed 40% of the exports. The government imposed a minimum export price (800 dollars per tonne until December 2022), which ended up causing protests in the streets. In view of this situation, the prices rose quickly and Indian onion importers sought out new suppliers.

This year’s production will be slightly lower compared to the previous one, reaching 30,200,000 tonnes, also with a smaller surface area of 1,740,000 hectares, compared to the 1,910,000 of the previous year.

Senegal and the Ivory Coast

Senegal is the main destination of onions from the Netherlands, but in recent years this trade relation has been dropping and the African country is opting for imports from China.

In the past, the Ivory Coast maintained a constant increase in its imports, being, along with Senegal, the main Dutch onion importer. However, this trend was broken in 2023, when there was a significant drop in imports from the Netherlands.

Owing to the high prices recorded by Dutch onions, the Ivory Coast decided to increase its purchases from countries closer to it.

Egypt

Egypt doubled its exports to the EU in 2022-23. The reason was the low European production and the reduced stocks of onions.

The devaluation of the Egyptian currency meant that exports had a highly competitive price on the market.

Exports remain very high during this current campaign.

The prices being paid to producers have risen quickly and have reached a good level. One result of this is the intervention of the Egyptian government starting on the 1st of October to guarantee that the local market is covered.

Global situation

Climate change and the extreme weather conditions are limiting onion growing and the most immediate consequence are the significantly high prices.

All over the world the demand is greater than the supply; therefore, there is great competition in the world onion trade. There is an insufficient supply of red onions in Europe and in the classification of all onions as a single category, there are important losses occurring due to calibre and quality.

India and Egypt are experiencing governmental restrictions to ensure that their own onions are not sold outside the country and their citizens are supplied.

The African onion importing countries have started importing from countries that are closer to them and also from China.

Brazil could enter the trade game and become an export power to Europe between March and May in 2024.

In general, all over the world there is great uncertainty due to the difficulty in supply and the rising prices.