As the sector gradually returns to its characteristic stability, with contained inflation and private labels experiencing more focused growth within short-assortment chains, price will remain important but to a lesser extent. In terms of distribution, the transformation of the sector has accelerated, with organized retail growing 0.6% in volume, while traditional retail continues to decline year after year, closing 2024 with a 3.6% decrease compared to 2023, according to Kantar Worldpanel’s “2024 Retail Balance” report.

This trend aligns with changes in household preferences when choosing where to shop. Since 2019, factors such as “the ability to complete the entire purchase” and “offers and promotions” have gained importance, along with “the quality of private label products”, though to a lesser extent. However, proximity and value for money remain the top reasons for store choice.

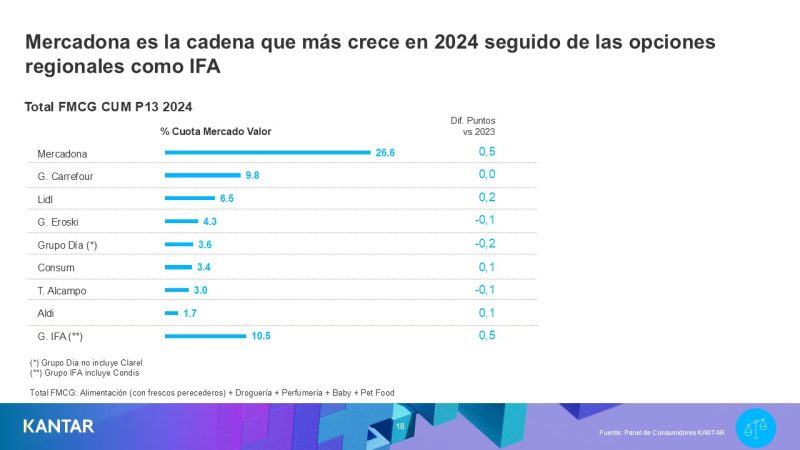

Moreover, Kantar Worldpanel data shows that chains that successfully maximize the quality-price equation are those that gain market share consistently.

Short-Assortment and Regional Chains Lead Growth

The year 2024 was marked by growth in both short-assortment chains (+0.6pp, reaching 37.7% market share) and regional supermarkets (+0.7pp, reaching 18%). Despite their contrasting market positions, both models demonstrate different ways to approach the quality-price relationship.

- Short-assortment chains leverage their private label strategy.

- Regional supermarkets focus on fresh perishable products, while their shoppers value brand availability and personalized service more.

This differentiation, along with regional chains expanding into new areas, has allowed them to continue gaining buyers (+3.6pp over the last five years). Notably, 68% of these new customers were acquired outside their traditional market areas, meaning outside their home region. According to Kantar Worldpanel, adapting product assortments to regional preferences has been key to this success.

Growth Driven by Each Chain’s Strengths

Mercadona, the leading short-assortment retailer, increased its market share by 0.5pp, mainly in the first half of the year and in regions where it still has room to grow. It faces 2025 with the challenge of maintaining positive momentum, after a record-breaking start to 2024. Key factors to watch include how external promotions impact its loyal customer base, given its no-promotion strategy, as well as its seafood section transformation.

Lidl enters 2025 on a positive note, having closed 2024 with +0.2pp market share growth, reinforcing its position as the fastest-growing chain since 2019 (+1.9pp). Lidl has strengthened its price image through marketing, promotions, and its loyalty program. However, the rise of regional supermarkets poses a challenge, as they are the only group of chains gaining customers at Lidl’s expense.

DIA maintains a strong performance following its store renovation, closing the second half of the year on a positive trend. It is the only short-assortment chain growing among senior households, offering an opportunity to develop a differentiated positioning within the segment.

Aldi starts 2025 as the fifth-largest supermarket in terms of shopper base, having doubled its customer base over the last decade. However, it still lags behind its main competitors in terms of category conversion rates.

Carrefour has been impacted by hypermarket channel stagnation, losing relevance among family shoppers, its traditionally strong consumer segment. However, its proximity store formats have helped balance this, closing the year stable at 9.8% market share.

Challenges for Retailers in 2025

According to Bernardo Rodilla, Retail Business Director at Kantar Worldpanel, the fastest-growing chains—short-assortment and regional supermarkets—face key challenges ahead.

- Short-assortment chains need to strengthen their position among senior consumers, a segment where they still have room to grow.

- Regional supermarkets can further increase basket sizes, making it crucial to understand and meet the specific demands of their customers in each market.

As 2025 approaches, the challenge will be maintaining this growth momentum, with consumers still prioritizing proximity, fresh products, and the quality-price balance in their shopping decisions.