With a business value exceeding €10 billion, pome fruit (apples and pears) is not only a key economic driver but also a cornerstone of the environmental and social sustainability of certain territories, such as Alto Adige in Italy or the Catalan region of Empordà.

On the one hand, this consistency in the harvest (10.4 million tons) allows for adequate prospects for balancing the European market, which will be able to meet local demand, intra-EU trade, processing and exports.

However, production that has not taken off in consecutive years reflects many current and future challenges in different areas: consistency in yields (due to major climate events such as those in Turkey), limited availability of phytosanitary tools, increasingly strict, as well as intrinsic sectoral transformations, whose steps are aimed at higher quality options but lower productivity.

Daniel Sauvaitre, president of the French ANPP (National Apple and Pear Association), calls for “common rules for packaging, for the authorization of phytosanitary products, or for export protocols, as basic principles that could resolve many of the current concerns about competitiveness and trust, which are now at risk.”

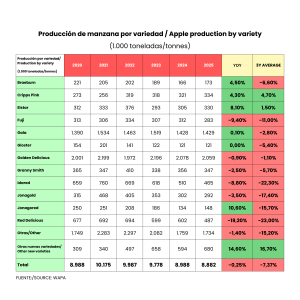

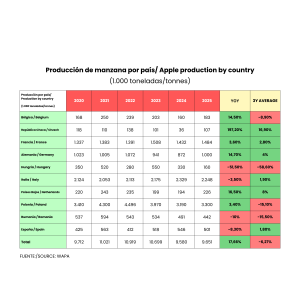

The European harvest is almost identical to last year’s, reaching 10.5 million tons, with an estimated negligible variation of 0.1%, but still 7.5% below the average of the last three and five years. The Golden variety, the most popular, is down nearly 1% to 2.06 million tons. Gala, the first to be harvested, stabilizes at 1.43 million tons. Meanwhile, Red Delicious and Idared will suffer significant declines, with 19.2% and 8.8% decreases, respectively.

Outside Europe, the United States and India expect slightly higher harvests than previous ones. However, in China and in non-EU neighboring countries such as Turkey, Serbia, Moldova and Ukraine, declines are expected, which could alter trade dynamics in the Middle East, Central Asia and Southeast Asia.

RELATED NEWS: EU: apple stocks down 9.9%, pear stocks drop 31.3%

Philippe Binard, secretary general of WAPA (World Apple and Pear Association), notes that “the sector faces worrying risks such as labor shortages, rising costs not offset by market prices, geopolitical instability, volatile trade and fluctuations in major currencies, the dollar and the euro. A stronger European Union is needed, with a robust single market based on common rules, especially in the face of a political trend toward greater subsidiarity, which threatens to weaken competitiveness and distort competition among EU producers.”

In this regard, as the EU defines the future of its CAP (Common Agricultural Policy), apple and pear producers express growing concern about the proposed budget cuts for the next Multiannual Financial Framework 2028–2034 and the decentralization of key competences to member states, which would mean a break with the basic principles of the CAP. “These changes could hinder the ability of European producers to efficiently face shared challenges,” says Binard.

Strong divergences between countries in pears

In pears, EU production is expected to increase by 1.4% year-on-year, reaching 1.79 million tons, although this means a 2.5% decline below the average of the last three years. Production in Italy will again fall sharply by almost 25%, but this is offset by a strong increase in Belgium, up 32%, and in the Netherlands, up 8.1%. Conference pear production will grow by 15% to reach 857,368 tons, while William BC will drop by nearly 17%.