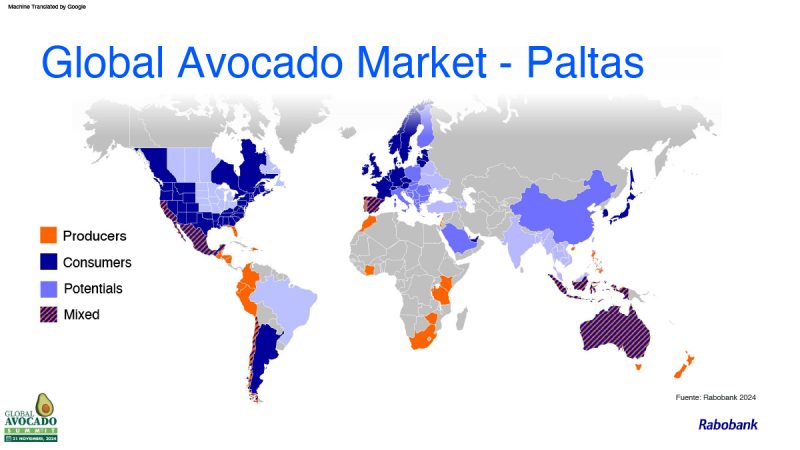

As highlighted by Gonzalo Salinas, research director at Rabobank, during the Global Avocado Summit:

“Global avocado exports will increase over the next five years and could reach 3.2 million tons for the 2028-29 season.”

In the United States and the European Union, this growth is driven by the health benefits of avocados, with global imports estimated to reach 46% and 25%, respectively, by 2033.

Expansion

The number of avocado-exporting countries has increased significantly in recent years, rising from 14 in 2014 to 23 in 2023, with expectations to exceed 30 by 2030.

Mexico, the undisputed global leader with 53% of global production, will continue to dominate the market, supported by sustained growth in states such as Michoacán and Jalisco.

In contrast, Peru, the second-largest exporter, is expected to see much slower growth due to a decline in new plantations over the past three years. Recent plantations have primarily been replacements for older ones.

Both Peru and Colombia play crucial roles as off-season suppliers, though they face challenges in expanding their plantations and implementing efficient production systems.

Mexican Dominance

According to Ramón Paz, a Mexican agricultural analyst, between 2015 and 2023, the Mexican avocado industry grew by 81% in volume, 52% in harvested area, and 19% in yield.

Paz noted that Mexican avocado exports to the United States for 2024-2025 are projected to reach 1,164,040 tons, a 10% increase compared to 2023-2024, and are expected to grow to 1,431,969 tons by 2029-2030.

With more certified land for export to the United States, Paz predicts that Jalisco’s production will increase from 183,500 tons in 2024-2025 to 226,250 tons in 2029-2030. Additionally, combined production from the states of México and Nayarit is forecast to surge from 11,500 tons in 2025-2026 to 115,500 tons in 2029-2030.

Michoacán, Mexico’s leading avocado-producing state, will remain at the forefront, with production rising from 1,330,000 tons in 2024-2025 to 1,540,000 tons in 2029-2030, a 16% increase, according to Paz.

However, one short-term obstacle for trade between Mexico and the United States is the threat of 25% tariffs, which the U.S. government has proposed to implement starting January 20.

U.S.-Mexico Dependency

The French Agricultural Research Center for International Development (CIRAD) warns that the United States is overly dependent on Mexican avocados, with no signs of diversification in its supply chain. Mexico accounts for 80% of total U.S. avocado supply throughout the year.

According to Eric Imbert, a CIRAD researcher, a new model of global avocado production is needed. Climate change is affecting rainfed farming regions in Michoacán, reducing fruit size and leading to lower prices.

Supply diversification is critical, as U.S. growth potential remains significant, supported by a steadily increasing population, including Hispanic communities, who are major consumers of avocados. Furthermore, avocado consumption in population centers along the U.S. East Coast remains significantly lower than on the West Coast.

On the other hand, Imbert points out that Colombia has not become the game-changing producer it was expected to be. Colombian farmers face low yields due to the country’s mountainous tropical climate, and excessive rainfall has hindered the implementation of efficient production systems.

Nonetheless, Colombian imports to the United States grew significantly in 2024, increasing by 119%.

Consumption

The United States, along with the United Kingdom and the European Union, will continue to be the main global consumption hubs for avocados.

The European market, led by the United Kingdom and the EU, is in “excellent shape” after a period of moderate growth over the past three years. Imports in 2025 are expected to surpass one million tons for the first time, with Peru, Israel, and Morocco as the primary suppliers.

RELATED NEWS: India is experiencing a “surprising” growth in avocados

In Asia, the growth potential is immense. Countries like Japan, China, and South Korea account for 60% of the global population but only 6% of global avocado trade. To capitalize on this opportunity, investment in education and consumer promotion will be essential.

“Countries with high per capita consumption, such as Mexico, Chile, and Australia, averaging over 5kg per person per year, demonstrate significant potential. Similarly, countries with moderate consumption levels of 2-3kg per person per year, particularly in Europe, could reach higher levels. Additionally, countries with low consumption but large populations, such as Italy and Poland, present significant opportunities,” Salinas notes.