The data from August talked about a moderately low harvest compared to the last few years. It has also introduced variations in some countries, such as Spain for example, where in August it seemed the harvest was going to be higher than the 2021-22 one.

However, as the months went by, a decreasing trend compared to the first forecasts has been observed. According to Philippe Binard, General Secretary of Freshfel, “we are not talking about a mistake, but rather an adjustment because the data evolves in terms of the size of the fruit, weather conditions, water, or depending on other factors that have an impact on the quality. We always have to look carefully at the two giants, Italy and Poland, because their productions have particular importance on the overall figure.”

“It is increasingly becoming more complicated to make a correct estimate as the weather conditions in August, September and October can have a significant effect both on the quality and on the quantity,” Binard explains.

The official production potential in the EU is around 13 million tonnes, a figure that is too high if compared with the amount that Europeans can consume. “The balance point for the sector could be 11 million tonnes, taking into account that part of this is stored and another part goes to the fresh market, which absorbs between 6 and 7 million tonnes.”

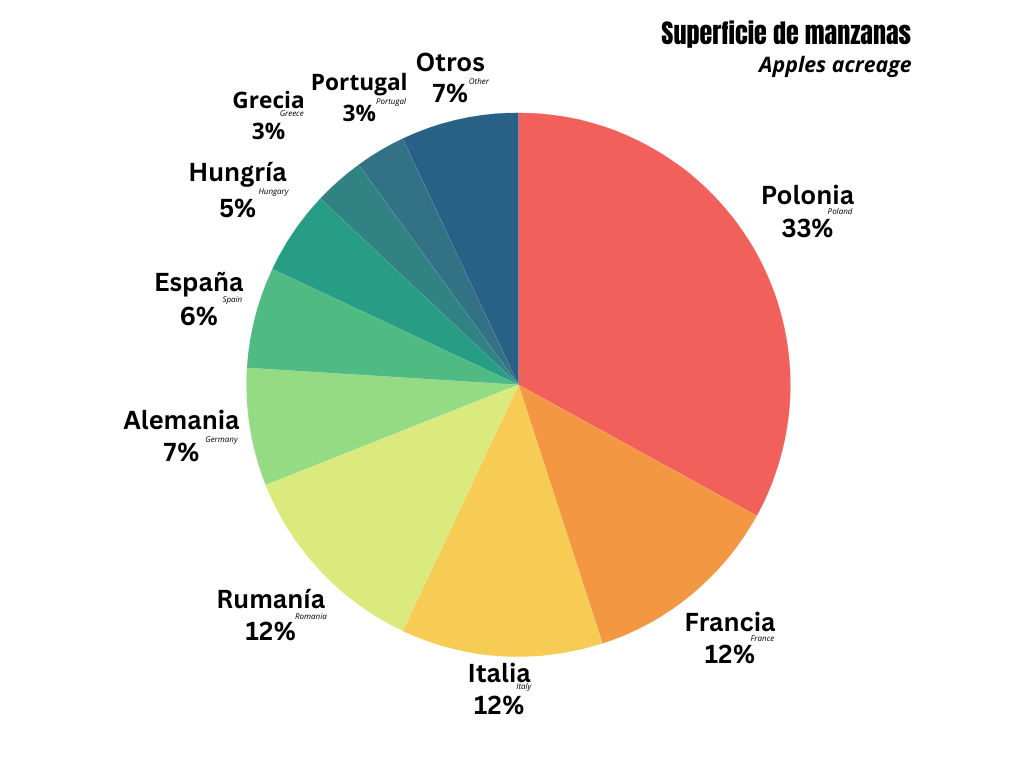

Fewer hectares of production

In Europe, the planted surface area for apples has dropped by 30,000 hectares over the past 10 years, mainly in Eastern countries (Poland, Hungary and Romania) although this trend might be partially compensated by higher productivity. In Poland, the increase in costs has meant that the small producers cannot manage to raise their production to stabilise such an important country from the point of view of the apple sector.

The season ended without any stock because there were very few imports from the southern hemisphere, with some seriously limited figures compared to previous years. From the beginning of the season, in the northern hemisphere the demand behaved correctly as the market was clean and the industry was demanding produce. There was a good balance between the fresh and the food processing markets. This situation meant that the prices were high at the start of the season and the sector benefitted from a smaller harvest of apple fruit than the previous year.

Organic produce

On the other hand, the differential between organic and conventional production has decreased, and organic produce is losing its appeal. This graph shows the difference between conventional and bio Galas.

The EU’s main export market is the United Kingdom, followed by Brazil, which has increased by 12%. Sales in India, the Balkan States and South America are all destinations that are growing.

Problems with consumption

Consumption has been dropping for some time now, not only in apples, but rather for all fruit and vegetables. This graph shows how consumption in 2018 was 15.4% and in 2022 it has only reached 14.3%.

Consumption per capita figures are different amongst all the countries, and we are moving within a range between 8, 14, 15 and even 16 kilos per person/year. This decline is coming slowly, but surely, in spite of the fact that the penetration level of apples in households is quite high.

The sector’s challenges include many aspects: adaptation to the weather conditions, start up of new farming practices, creating new consumption dynamics such as snacking, or adjusting the drop in demand of organic produce. “In the end, a good marketing strategy could bring solutions that can also be applied to other fruit and vegetables because the message is becoming increasingly clear: 400 grams must be eaten for reasons such as health, and 400 grams for the environmental impact that fruit has compared to other products. “At Freshfel as an organisation, we are no longer asking our political actors for this amount to be set at 400 grams, but rather at 800. This policy contrasts with the incoherence of some initiatives such as the Farm to Fork, the Green Deal or the plan to fight against cancer. The message is clear: we need to produce and eat more fruit and vegetables.”

As can be seen in the graphs, in Germany, consumption has dropped from 15 to 14 kilos per person; in France, from 14 to 13 kilos; in Poland it is around 14 kilos, and in Spain around 10 kilos per person.