In this context, countries such as India and the African continent will be decisive over the coming decades for trade in apples of European origin.

India’s potential is so significant that it is expected to reshape the global apple market. Its current production stands at 1,000,000 tonnes, while imports reach 3,000,000 tonnes. According to Marc Peyres, executive at Blue Whale, “this is just an example of what will happen in Africa within ten years.”

Other trade trends

Observed trends are mixed. For instance, sales to the United Kingdom are declining, while exports are increasing to North Africa, the Middle East and several Central American countries.

Meanwhile, sales to Southeast Asia are showing a slight decline, a situation closely linked to the impact of a poor harvest in Turkey, an unpredictable geopolitical environment, increasingly complex logistics and growing political unilateralism, as opposed to bilateralism, which offers limited benefits.

Declining consumption in developed countries

Consumption levels in developed countries are becoming an increasing concern for the sector, and “it is necessary to stimulate demand in one way or another,” explains Philippe Binard, Secretary General of WAPA (World Apple and Pear Association).

The most worrying figure is that consumption in Europe is falling by 2% each year.

Sector concerns

From a production standpoint, the main sources of concern are climate change, increased regulation and low yields. Climate change implies the need for further research into new varieties that are more tolerant to heat. In addition, due to climatic turbulence, production should increasingly be protected by netting systems, which entails higher costs for growers.

Latest figures

It should be noted that Poland is increasing production by around 400,000 tonnes, mainly in late and mid-season varieties. Quality remains uncertain at this stage and could affect long-term storage, potentially increasing pressure on prices in both industry and retail.

German production may exceed August forecasts by between 60,000 and 80,000 tonnes, with higher output in the Elbe River area. Trade up to Christmas was slow, as a significant share of the population owns private orchards and is largely self-sufficient.

RELATED NEWS: Stability in European apple production does not ease concerns

Between Belgium, the Netherlands and France, production may rise by 10,000 to 20,000 tonnes. All three countries are experiencing declining consumption trends, and in France, a major exporter, sales are slow both within the EU and on the domestic market.

Although the global geopolitical context does not inspire confidence, exports remain relatively stable and there is a slight recovery in organic consumption.

New varieties

New varieties

“When it comes to introducing new varieties, we always talk about local and organic, but in reality what sells are good apples,” says Marc Peyres.

Stocks

As of 1 November, stocks were 12% higher than the previous year, even without including data from Poland, the largest producer in numerical terms.

The four main apple-producing countries are Italy, France, New Zealand and the United States. Together, they account for 9% of global production and 30% of exports.

“Last season, Italy achieved a record year in terms of payments to growers, and for VIP, the main export variety is Golden Delicious,” says Juan Francisco Rivera-Urdaz, executive at VIP.

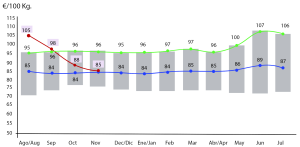

For his part, Joan Serentill, President of the Catalan pome fruit sector, stated during the Pomatec Congress that “although the 2024/25 campaign could be described as good, sizes fell short and prices were under pressure. This year the harvest is 22% lower. Therefore, we must export the types of apples that are not consumed locally and import what the domestic market demands.”

The French National Apple Producers Association (ANP) reports that this season will bring higher volumes, good quality and strong sugar levels, although consumption among French consumers continues to decline.

Challenges

From Afrucat, its president Andreu Viladegut believes that the main challenges in Catalonia lie in finding new varieties adapted to climate change, renewing protective netting and securing phytosanitary solutions to combat emerging pests following the withdrawal of key products such as mancozeb, acetamiprid and fludioxonil.

“It is illogical to withdraw substances without having new tools to control the same pests, as this makes production unviable. This is compounded by extremely long waiting times for the registration of new products.”

Other legislative factors also have a major impact on the sector, particularly the different national applications of what is theoretically a single regulation within a single market. This directly affects sales, marketing and segmentation. Beyond bureaucracy, Philippe Binard points out that “issues such as extended producer responsibility, recyclability and reuse targets must also be addressed.”

“The key to the campaign lies in ensuring that prices fully cover production costs, as well as in maintaining fair relationships along the supply chain within the new UTP framework (unfair trading practices and competitiveness),” Binard adds.

Four global business areas

The global apple business can be divided into four categories of countries:

Countries with a state-driven political strategy, such as Poland, Russia and China, representing 55% of global area, 56% of production and 27% of exports.

Turkey and Serbia, operating independently, accounting for 5% of global area, 3% of production and 5% of exports.

Four leading countries: Italy, France, New Zealand and Washington State (USA), representing 4% of global area, 9% of production and 30% of exports.

Three second-tier countries—Chile, South Africa and Spain—accounting for 2% of global area, 3% of production and 16% of exports.

New varieties

New varieties